|

原文来自Farnam Street网站。Farnam Street是巴菲特公司所在的街道。能量圈是以巴菲特为代表的价值投资者坚守的最重要原则之一。对于从事风险投资行业的人而言,投资的是创新,常常因为追逐创新而很容易忘记能力圈原则。实际上,这条原则不仅适用于投资也是用于生活。

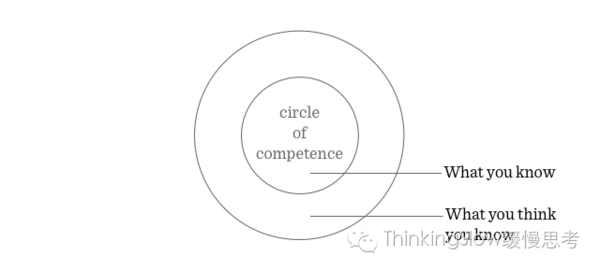

“I’m no genius. I’m smart in spots—but I stay around those spots.” — Tom Watson Sr., Founder of IBM “我不是天才。我只是在某些地方聪明,但我呆在那些地方。“ 汤姆.老沃森,IBM创始人 The concept of the Circle of Competence has been used over the years by Warren Buffett as a way to focus investors on only operating in areas they knew best. The bones of the concept appear in his 1996 Shareholder Letter: 能力圈的概念,巴菲特多年来一直使用,直播,作为专注的投资人围绕他们最熟悉的领域投资的一种方法。这个概念的要点第一次出现,是在他1996年致股东的信里: What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital. 投资人需要的是能够正确的评估那些选定的企业的能力。所谓“选定”是说:你不需要成为每家公司的专家,甚至不需要很多。你只需要能够评估你能力范围内的公司。能力圈的大小不是关键,而了解它的边界则至关重要。 Circle of Competence is simple: Each of us, through experience or study, has built up useful knowledge on certain areas of the world. Some areas are understood by most of us, while some areas require a lot more specialty to evaluate. 能力圈很简单:我们每个人,通过经验或学习,已经建立对世界某些领域有用的知识。有些领域我们大多数人都理解,而有些领域需要更多的专业知识来评估。 For example, most of us have a basic understanding of the economics of a restaurant: You rent or buy space, spend money to outfit the place and then hire employees to seat, serve, cook, and clean. (And, if you don’t want to do it yourself, manage.) 例如,我们大多数人都对餐厅经济学有基本的了解:你租房或买下物业,花钱来添置装备,再雇佣人领座、上菜、烹饪和清洁。(如果你不想自己经营,还可以找人管理。) From there it’s a matter of generating enough traffic and setting the appropriate prices to generate a profit on the food and drinks you serve—after all of your operating expenses have been paid. Though the cuisine, atmosphere, and price points will vary by restaurant, they all have to follow the same economic formula. 剩下来的事情,就是要产生足够的客流,然后合理的定价保证你卖的食物和饮料能产生利润—毕竟你的经营费用已经都花在前面了。虽然每家餐厅的美食、环境和价格都有所不同,他们都遵循相同的经济公式。 That basic knowledge, along with some understanding of accounting and a little bit of study, would enable one to evaluate and invest in any number of restaurants and restaurant chains; public or private. It’s not all that complicated. 这个基本知识,加上对财务的一些了解和一点点研究,就可以让人具备评估和投资餐厅或餐厅连锁的能力。不管是上市公司还是私有公司。都不是那么复杂。 However, can most of us say we understand the workings of a micro-chip company or a biotech drug company at the same level? Perhaps not. 然而,我们大多数人可以说,我们同样程度的了解了微芯片公司或者生物制药公司的运行原理吗?或许不能。 But as Buffett so eloquently put it, we do not necessarily need to understand these more esoteric areas to invest capital. Far more important is to honestly define what we do know and stick to those areas. Our circle of competence can be widened, but only slowly and over time. Mistakes are most often made when straying from this discipline. 但正如巴菲特说得,做投资而言,我们并不一定需要了解这些更深奥的领域。更为重要的是,诚实地定义我们知道什么,并坚守在这些地方。我们的能力范围可以扩大,但只能缓慢地,随着时间的推移。一旦偏离了这个纪律,就经常会犯错误 Buffett describes the circle of competence of one of his business managers, a Russian immigrant with poor English who built the largest furniture store in Nebraska: 巴菲特描述过他的一个下属公司的创始人的能力圈,这是一个俄罗斯移民,英语不太好但是却创建了内布拉斯加州最大的家具卖场: (责任编辑:本港台直播) |